The success of The Merge and the subsequent Shapella hard-fork showcased Ethereum's ability to smoothly ship significant network upgrades. However, this transition was not without its challenges and learning curves. Over the past year, Ethereum’s journey has been punctuated by encounters with malevolent entities, unintended software anomalies, and disparities in value distribution.

As we mark the one-year anniversary of The Merge, we wanted to take a moment to review some of the significant advancements that have redefined the Ethereum ecosystem as well as their positive and negative impacts on the network, its end-users, and the critical actors in the MEV supply chain.

TL:DR several of the key lessons we learned included:

- The pursuit of maximum profits fuels centralization at the core of the network.

- Vertically integrated Searcher/Builders have proven positive economics, while credibly neutral Builders struggle to find margin and hence revenue/profitability.

- MEV-Boost Relay operations are effectively 100% risk, 0% reward.

- Based on the latest in ePBS research, trusted third-party Relays at the core of the network will be a fact of life for the foreseeable future.

- Sanctions – and OFAC SDN specifically – played an unexpected role in shaping staking and PBS landscape.

- Promises of ‘protecting’ users from the adverse effects of MEV remain to be fully proven.

MEV-Boost and Proto-PBS

The Merge and the migration from Proof-of-Work to Proof-of-Stake was the most consequential upgrade to the Ethereum network so far. The Merge brought Proposer/Builder Separation (PBS), enabling the decoupling of the technically intensive act of block building from the decentralized consensus act of block proposal.

In-protocol PBS – aka enshrined PBS – was not ready at The Merge. To enable the outsourcing of block production, the Ethereum Foundation partnered with Flashbots to develop a ‘temporary’ outside-the-protocol block auction approach known as MEV-Boost. MEV-Boost bridged the gap between Block Builders and Block Proposers – that is, the Validator who is randomly selected to be the tip of the chain and hence propose the contents of the next block to the network.

MEV-Boost introduced net-new actors known as Relays to act as trusted intermediaries between Block Builders and Proposers. These Relays effectively serve as block auctioneers that ensure Builders are honest in their bids to Proposers, and that Proposers cannot steal the MEV bundles from Builders or Searchers.

MEV-Boost and Relays saw explosive adoption among validators thanks to the increase in block value that specialized Block Builders are able to generate. In the last 30 days, 96% of all blocks that landed on-chain were outsourced to independent Block Builders via the MEV-Boost network, with the average MEV-Boost block being 5.57x more valuable than locally created blocks.

The rewards generated from Block Builders can be thought of as a lottery ticket for Proposers because of the variability in payouts. Some blocks have payouts that far exceed any profit a Validator could achieve through building locally. Throughout the year, these rewards were, as expected, spiky, with the last two weeks' average reward paying out 0.06 ETH per block. Occasionally, a rare high-value block could pay out tens of thousands of dollars, with even rarer single block rewards going as high as 691 ETH – over $1.0 million USD at the time.

Decentralization: Always a work in progress

Stakings pools like Lido, Rocketpool, and Coinbase grew into essential players in the ecosystem. The draw of outsourced staking infrastructure and still being liquid through liquid staking protocols were influential in onboarding new stakers prior to the Shapella upgrade.

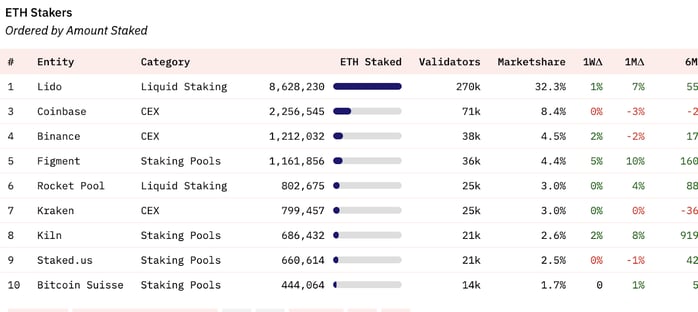

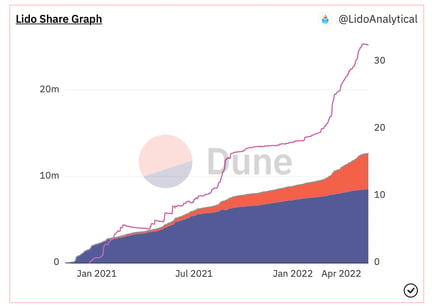

The popularity of staking pools has had significant impacts on the overall decentralization of the validator network. Staking pools consolidate a large portion of staked ETH into a few entities. To date, the three leading staking pools together have over 11 million in staked ETH, or about 43% of the network's total economic security budget.

Source: https://dune.com/hildobby/eth2-staking

Today, Lido alone controls more than 30% of all staked ETH and therefore controls more than 30% of all blocks. There are ongoing discussions within the research community on various mechanisms to cap liquid staking providers’ dominance in efforts to prevent further validator centralization.

Source: https://research.lido.fi/t/should-lido-on-ethereum-be-limited-to-some-fixed-of-stake/2225

Block Building: The fight to stay competitive

Block building has become increasingly competitive given the current full-block auction model of MEV-Boost. That is, each block auction results in a single auction winner who wins the exclusive right to build the entire block – and many auction losers.

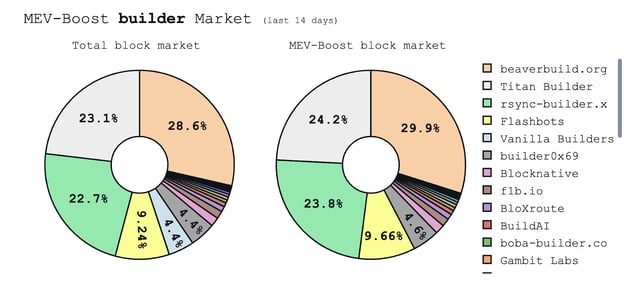

To gain an edge, some Block Builders have become vertically integrated with Searchers, adding proprietary order flow to their blocks and enabling differentiated MEV profits. This has resulted in neutral builders struggling to sustain revenue. In the last 14 days, ~75% of the blocks on the Ethereum network were built by just three block builders—two of which are vertically integrated Searcher/Builders.

Source: https://mevboost.pics/

Lesson Learned: Vertically integrated Searcher/Builders dominate both block share and Builder profitability while credibly neutral Builders struggle to find margin and hence revenue/profitability.

Slashing: How a new attack vector enabled a malicious validator to steal millions

On April 3rd, the Ethereum network witnessed a new class of attack from a malicious Validator. The attack broke the assumed atomicity of MEV bundles and extracted roughly $25 million in gains from a handful of unprotected MEV Searcher bots.

This was a deliberate, calculated attack involving honeypot transactions in the public mempool with significant MEV potential. The malicious Validator, later dubbed “Sandwich the Ripper” exploited undiscovered flaws in Relays operations. Because Relays at that time did not fully verify all parameters in the block header – and the parent and state root specifically – the Relay network released an invalid block that contained every signed transaction to the malicious validator. This enabled Sandwich the Ripper to alter these transactions before proposing a new, valid block to the network. While Sandwich the Ripper was later slashed 32 ETH, they still managed to extract nearly $25 million in total profit.

In response to this class of attack, Relays now publish their blocks to the beacon network before returning them to the Proposer. And if this fails, the Relay network does not return a payload to the Proposer at all.

Lesson Learned: Relays are necessary for the orderly operation of the Ethereum network. Even seemingly minor issues at the Relay network can and do have serious consequences for network participants.

MEV-Boost Relays today: 100% risk, 0% reward

In the world of Proposer/Builder Separation, Relays play a pivotal yet undervalued role. Relays impact the entire MEV supply chain, from Searchers to Block Builders to Validators, connecting these untrusted stakeholders in a symbiotic, permissionless transaction ecosystem. Through Relays, Validators are able to outsource block production to Block Builders, enhancing the ecosystem's efficiency and economic security while measurably increasing Validator revenue.

Yet, despite this critical role, Relays currently lack any economic rewards. In practice, Relays sometimes have negative rewards. Relays are essentially operated as public goods.

Today, the Relay landscape is increasingly centralized with just seven unique Relay operators controlling 99% of the MEV-Boost network. If Relays fail to do their job(s), Validators suffer missed slots, or worse as malicious actors can exploit the network.

Lesson Learned: MEV-Boost Relays are effectively 100% risk, 0% reward, with a small number of actors participating. While Relays were only meant to be temporary until ePBS, they have proven to be critical for the security and orderly operation of the chain and are unlikely to go away for the foreseeable future. It might be only a matter of time before we see vertically integrated Searcher/Builder/Relays as Relay operators cast about for sustainable economics.

A rise in MEV awareness and MEV protection

Over the last year, MEV awareness has grown. Transaction originators began to understand the negative impact frontrunning and sandwich bots had on transaction settlement. Innovative products emerged to combat these negative externalities, such as

- Private transaction RPC endpoints that enable users to send transactions privately to Block Builders

- Order Flow Auctions (OFAs) that enable private transactions to be backrun by MEV searchers with a percentage of the profit being shared with the user

- Transaction Boost: Blocknative’s MEV protection aggregator that enables sending to all available builder and OFA RPCs.

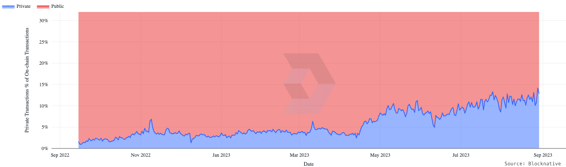

The network has seen a surge in private transactions as users attempt to shield themselves from MEV, with private transactions on-chain jumping from about 5% pre-Merge to nearly 15% today.

However, the MEV protection ecosystem has a ways to go to truly protect users. An analysis using the Blocknative Mempool Archive has shown that private transactions receiving front-running protection do not necessarily result in better settlement. Counterintuitively, our analysis of public and private transactions revealed that many users who sent their transactions privately incurred more slippage than those who sent publicly.

Lesson Learned: Promises of ‘protecting’ users from the adverse effects of MEV still have a ways to go. We expect the MEV protection market to continue to evolve. In the long run, users should not have to worry about the complexities of MEV. We believe that forward-thinking wallets will play a critical role in protecting their users from the ill effects of MEV and providing the best settlement outcomes.

Looking ahead

By building and operating a Block Builder and Relay from scratch, we have learned from the complexities of the MEV supply chain firsthand as an active, in-the-transaction-flow participant. These insights have inspired us at Blocknative to create new functionality to help protect Web3 users.

At Blocknative, we're excited about the future and our role in improving outcomes for web3 users through real-time access to pre-chain data, increased transaction visibility, and MEV protection. We will continue to work alongside the community to ensure critical infrastructure is made available to all users across the ecosystem, democratizing access to pre-chain insights.

If you are a wallet or dapp developer serious about providing the best transaction experience for your users and want the infrastructure to make it happen, we would love to work with you.

Special thanks to Matt Cutler and Joules Barragan for your help in providing feedback on this article.

Observe Ethereum

Blocknative's proven & powerful enterprise-grade infrastructure makes it easy for builders and traders to work with mempool data.

Visit ethernow.xyz

.png)